Oh wow! An article about taxes! I know, sounds boring right? But, if you are considering a home purchase in SC, it is necessary to understand how taxes work in South Carolina! In addition to South Carolina being such a great place to live, A USA Today article ranked South Carolina as the 7th lowest effective property tax rate in the country for 2017! So, let’s discuss the SC tax rates involving real estate, vehicles, sales, and income. Plus, we will discuss how each could affect your bottom line and lifestyle. You know you want some money left over to enjoy the golf, food, and outdoor life!

picture source: Unsplash by Rawpixel

Benefits of Living in South Carolina

| Benefits | Available? | |

| Amazing Golf | Yes | |

| Endless Dining | Yes | |

| Beach | Yes | |

| Entertainment | Yes | |

| Diverse Culture | Yes | |

| Affordable Living | Yes | |

| Low Taxes | Yes |

South Carolina Property Tax

South Carolina breaks down real estate property tax rates into two main categories. The two SC tax rate categories are based on residents and nonresidents. Basically, if you live in SC the property tax rate is lower than owning a second home or rental property. Sometimes buyers are surprised at the nonresident property taxes, but they certainly aren’t to the level of many northern states. Let’s discuss the main differences.

Buying a SC Property as a Nonresident

The standard SC property tax rate for farms and residential homes is 6% of the assessed value, which is higher than the primary residence rate. Buyers or property owners with a second home or rental property will pay this standard, nonresident tax rate. Besides the property tax rate, each county and township (if applicable) has a millage rate as well. You will see how the millage rate factors into the tax as well below.

Warning!

Of course, everyone would love to pay the lower primary residence tax rate. A word of advice – Do not say a home will be a primary residence just to get the lower taxes when it is really not going to be. Believe it or not, a common question goes like this, “Can I just say that it is my primary residence?”. Just don’t go there, because it is mortgage fraud and the tax office would require proof of residency too.

Buying a Principal Residence in SC

As mentioned, residents have an advantage in property taxes. Actually, SC property tax rates are among the best in the country! The resident property tax rate is 4%, plus an owner occupied home could additionally qualify for residential exemption. The SC residential exemption reduces the property tax bill even lower after the 4% discounted tax rate!

Here is an example. In order to receive the Horry County SC Residential Exemption, homeowners must prove residency. This is accomplished by completing their “Legal Residence Special Assessment Application” once the applicant is a homeowner in SC. This form must be given to the Horry County Tax Assessor’s office.

SC Tax Residential Exemption Example

Below is a hypothetical example for calculating property taxes on a primary residence including the residential exemption in Horry County.

| Fair Market Value | $125,000 | |

| Assessment Ratio | X 4% | |

| Assessed Value | $5,000 | |

| Sample County Millage Rate | X .21 | |

| Taxes Before Discount | $1,050 | |

| Exemption Tax Credit | – $600 | |

| Total Taxes With Discount | $450 |

Keep in mind that this chart will give you a “close figure” and doesn’t take all factors into account. Each property could be a little different based on district and more. If you have located a specific property, look it up first in the county tax website. If the 6% tax rate is used, you could use the above example to figure the approximate lower primary residence taxes.

SC Tax Homestead Exemption

South Carolina has another property tax discount called the homestead exemption. It is an exemption of property taxes on the first $50,000 in Fair Market Value of your Legal Residence for homeowners over age 65, totally and permanently disabled, or legally blind. If a homeowner potentially fits within these guidelines, apply for the exemption! It could save a lot of money.

SC Property Tax Exemption for Disabled Veterans

A truly deserved benefit in South Carolina is for disabled Veterans. 100% service connected disabled veterans may qualify as exempt from SC property taxes. That’s right no property taxes! Plus, Veterans could use a VA home loan for potentially a money down purchase as well. Learn more about how this SC Property Tax Exemption works for Veterans.

Other South Carolina Taxes

Of course, its not all about real estate property taxes. There are other SC tax rates such as income tax, sales tax, and vehicle tax. Overall, South Carolina ranks well in these areas too.

South Carolina Income Tax

South Carolina income tax rates are based on levels of income. The rates range from 0 – 7%. Like other states, the taxable income is based on a function of the adjusted income from the federal return. But, the highest SC income tax rate is 7% which is pretty good compared to other states. Actually for 2018, Wallethub ranks South Carolina as the 10th lowest effective tax rate based on income.

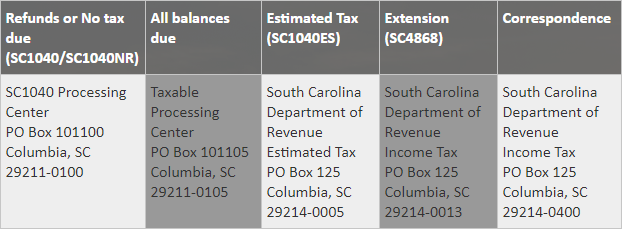

Graphic Source: SC DOR

Have SC income tax related questions? Contact the South Carolina Department of Revenue.

SC Vehicle Property Tax

Although SC ranks as one of the lowest states for property taxes, according to Wallethub, it is on the high side for vehicle taxes in relation to income. But, the taxes are pretty reasonable overall. If purchasing a vehicle in SC, there is a one-time Infrastructure Maintenance Fee (IMF) rather than a sales tax. This fee is 5% of the price up to a maximum of $500 effective July 1, 2017. The IMF is in addition to applicable title and registration fees and annual personal property taxes. Additionally, if relocating to SC, residents are required to register vehicles within 45 days. Steps for new SC residents:

- Pay county vehicle property tax with county auditor

- After paying, keep original paid tax receipt

- Pay one-time $250 IMF

- Register & title vehicle(s) in person or by mail. More details Title transfer page

SC Sales Tax

A sales tax is a percentage of goods and certain services in South Carolina. The state sales tax rate is 6% with the option of local areas to charge an additional percentage. These sales tax rates are, according to Tax Foundation, among some of the higher taxed states and believe it or not, there are a few states with zero sales tax.

Qualifying for a Mortgage on a South Carolina Home

No matter if your purchase is a primary home, beach home, mountain retreat, golf villa, condo, rental property, retirement home, or downsizing, there are so many mortgage options available. Primary residence options include several no money down options like VA home loans, USDA Guaranteed loans, and SC down payment assistance. Furthermore, there are low down payment options like FHA, HomeReady 3% down, Home Possible 3% down, and conventional 5% down loans.

Even a second home only requires 10% down payment and even 5% of the price could be a gift! Many don’t realize that buying a vacation home could be so obtainable If buying a rental property, down payment may be as low as 20%. To help in qualifying for a rental home, we could count 75% of the market rent for the property. A lease agreement is not even required!

So, whatever your home goals are, make sure that you give us a call or complete the information below. You will be glad that you did!

Realtors can follow on ActiveRain or Connect on Linkedin for more news. See why service matters